Credentials

How to Apply for Aid (FAFSA)

Costs | Aid Programs | How to Apply for Aid (FAFSA) | How to Apply for Aid (DREAM) | After you Apply | Award Notification | Getting your Aid | Keeping your Aid

You can still complete the 2025-2026 FAFSA!

School Code: 001144

You must reapply for financial aid - including loans, grants, and Federal Work Study employment - each year.

Your FAFSA is used to determine your eligibility for Federal, California State, and Cal Poly Pomona aid, and some scholarship providers may use your FAFSA information to determine whether you qualify for their awards.

When you fill out the FAFSA, you are applying for aid for a specific year. In order to receive aid the next year, you’ll need to submit that next year’s FAFSA. Luckily, Federal Student Aid makes it easy for you by allowing you to submit a Renewal FAFSA that remembers certain information you reported the year before and places it in your new FAFSA.

The FAFSA Application becomes available every October 1st for the next academic year – and the priority deadline for applying is March 2nd (for the 2025 – 2026 academic year, the priority deadline was extended to April 2, 2025).

Be sure to file before the priority filing deadline in order to be considered for the maximum types of aid.

If you miss the Priority Filing Deadline you will still be considered for the Federal Pell Grants and Federal Direct Loans.

2025-26 FAFSA Now Available!

The 2025-26 FAFSA is now available (as of November 19, 2024)! Submit your FAFSA by March 3, 2025 for the 2025-26 academic year (Fall 2025, Spring 2026, Summer 2026).

Learn More

Students in the Credential Program are considered 5th year undergraduate students for Financial Aid purposes. Students who already possess an initial Teacher Credential, and are now working on an additional credential, are only eligible for federal loan funds (at the 5th year undergrad level) or for private education loans.

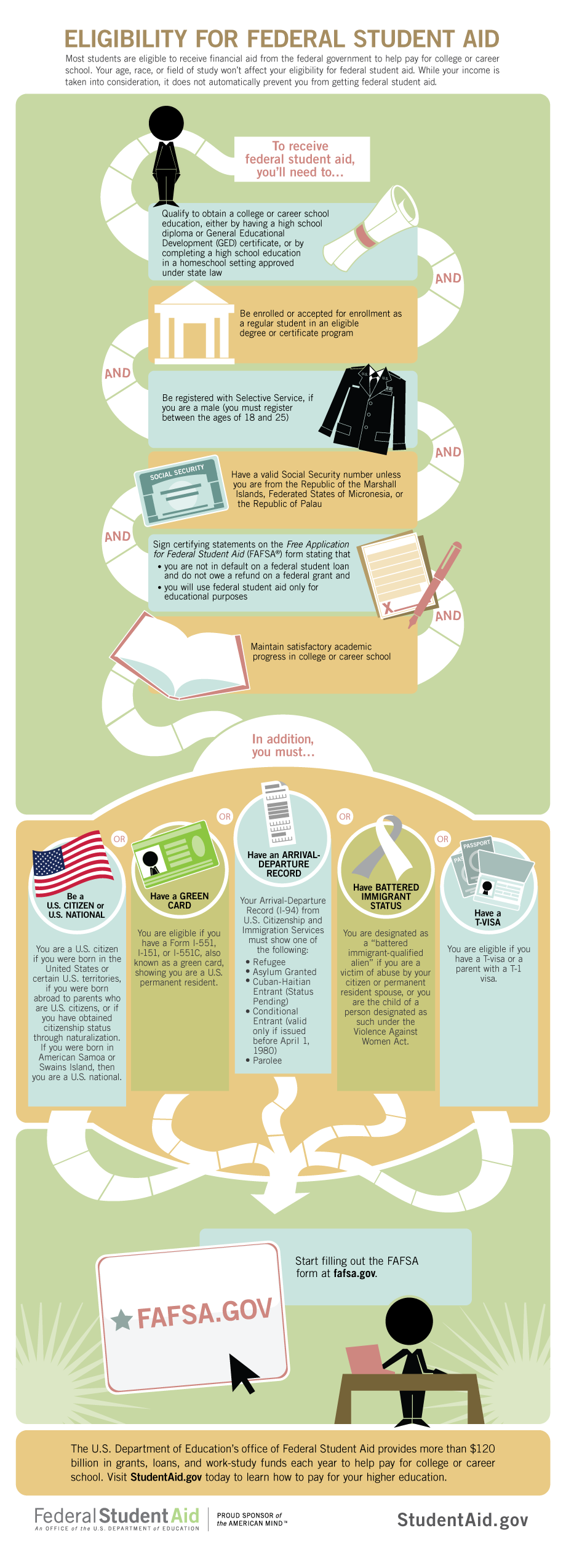

In order to be eligible for funding through the FAFSA Application, you must meet the citizenship eligibility criteria for Federal Student Aid:

- You must be a U.S. Citizen OR

- You must be an eligible non-citizen (i.e., Permanent Resident)

PLEASE NOTE: Students who received a Social Security Number through the Deferred Action of Childhood Arrival (DACA), and who qualify for AB540, should complete the California Dream Act Application in order to be considered for state financial aid, as they are NOT Eligible for Federal Student Aid.

In addition to citizenship status, you must meet the other general eligibility criteria for federal student aid. Review the information from Federal Student Aid for details.

Fact Sheets

Credential students are considered 5th year undergraduates for financial aid purposes.

To ensure all needed information is provided on the application, and to avoid delays in the processing of your financial aid file, please answer the following questions on the FAFSA Application as indicated below:

| Question | Answer |

|---|---|

| What will your college grade level be when you begin the school year? | 5th year/other undergraduate |

| What degree or certificate will you be working on when you begin the school year? | Teaching credential (nondegree program) |

| At the beginning of the school year, will you be working on a master's or doctorate program (MA, MBA, MD, JD, PhD, EdD, graduate certificate, etc.)? | No |

The FAFSA asks for important personal identification information as well as financial information. You may be asked to provide identification and financial information for your parents as well. Details about the type of information, and documents needed to complete the application are available from Federal Student Aid.

You or your parents may be able to have your tax & income information imported directly from the IRS into your FAFSA. Learn more about providing financial information from Federal Student Aid.

Transferring Data from the IRS

Additional Resources

For FAFSA Applicants, you’ll need an FSA ID, a username and password combination that allows you to sign your FAFSA electronically. If you are a dependent student you should also have your parent request an FSA ID.

You can get your FSA ID as you fill out the FAFSA, but getting an FSA ID before you begin the FAFSA could prevent processing delays, and it only takes a few minutes to apply. You can find out more information and apply for an FSA ID.

Credential students are considered 5th year undergraduates for financial aid purposes.

All applicants for financial aid are considered either independent or dependent. Students who are under the age of 24 as of December 31 of the award year and do not meet any other very limited criteria, are considered “Dependent” for financial aid purposes.

Dependent students are required to include information about their parents on the application. By answering a few questions, you can get a good idea of which category you fit into. Visit Federal Student Aid’s page on Dependency Status for information on the difference between a dependent and an independent student, and to determine your dependency status for financial aid purposes.

Fact Sheets

- English Language: Am I Dependent or Independent? (PDF)

- Spanish Language: Soy alumno/adependiente o independiente? (PDF)

If you’re a dependent student, you’ll need to report parent information on your FAFSA. Visit Federal Student Aid’s page on reporting parent information to find out who counts as your parent, what to do if you don’t live with your parents, and what to do if you don’t have access to your parents’ financial information.

Divorced or Separated Parents Who Live Together

- If your divorced parents live together, you’ll indicate their marital status as “Unmarried and both

parents living together,” and you will answer questions about both of them on the FAFSA Application. - If your separated parents live together, you’ll indicate their marital status as Married or remarried (not Divorced or separated), and you will answer questions about both of them on the FAFSA Application.

The FAFSA Form & FSA ID Tips for Parents:

Fact Sheets

- English Language: Who is My Parent When I Fill out the FAFSA? (PDF)

- Spanish Language: A quiénes se les considera mis “padres” para efectos de la FAFSA? (PDF)

If you are a Dependent Student, at least one parent must sign your application, even if you do not live with your legal parents (your biological and/or adoptive parents).

In order to electronically sign your FAFSA, your parent(s) will need a valid Social Security Number in order to apply for an FSA ID. If your parent is not able to apply for an FSA ID, you can print a signature page by selecting Print Signature Page on the “My FAFSA” or “Signature Status” page. Visit Federal Student Aid for more details.

Your family is primarily responsible, to the extent they are able, for paying for your college expenses. Under very limited circumstances, an otherwise dependent student may be able to submit the FAFSA without parent information due to special circumstances.

In situations such as the ones below, you may be able to submit your application without parent information despite being considered a dependent student:

- Your parents are incarcerated.

- You have left home due to an abusive family environment.

- You do not know where your parents are and are unable to contact them (and you have not been

adopted). - You are older than 21 but not yet 24, are unaccompanied, and are either homeless or self-supporting and at risk of being homeless.

The online application will ask you whether you are able to provide information about your parents. If you are not, you will have the option to indicate that you have special circumstances that make you unable to get your parents’ information. The site then allows you to submit your application without entering data about your parents.

Once you’ve submitted your FAFSA, you will need to reach out to our office to discuss your options. Be sure to gather as much information and supporting documentation about your situation as you can (legal documents; letters from a school counselor, a social worker, or clergy member; any other relevant information that helps document your special circumstance).

Fact Sheets

Completing the FAFSA is not the last step; your FAFSA has to be processed, and then you get an Expected Family Contribution (EFC), which Cal Poly Pomona uses to figure out how much aid you can get. Find out more about what happens after you fill out the FAFSA, how to review your Student Aid Report and how to correct any errors.

If you were awarded Cal Grant A or B as an undergraduate, you may be eligible to renew your Cal Grant for up to 1 additional year while enrolled in a teaching credential program.

The additional year of payment may be provided if you are seeking an initial teaching credential but cannot be used for other graduate level courses of study.

Submit the G-44 Request for Cal Grant Teaching Credential Benefits Form

After submitting your FAFSA Application, you’ll need to submit a G-44 Request for Cal Grant Teaching Credential Benefits form to the California Student Aid Commission (CSAC) at the address on the form.

- Submit your G-44 request after completing your bachelor’s degree and after being formally or conditionally accepted into a teaching credential program.

CSAC and Your WebGrants Account

After you have filed your FAFSA Application, you can go on-line and check the status of your Cal Grant application by logging on to WebGrants for Students and creating an account. This secure site provides you with resources, information and tools to assist you with the college financial aid process. It will also let you view the status of your Cal Grant application, update your address, submit corrections, view your payment history, update your college of attendance, or satisfy outstanding requirements

Creating an Account (WebGrants 4 Students)

Account Recovery (WebGrants 4 Students)

Additional Resources

If you missed the Priority Filing Deadline (May 2nd for the 2024-2025 year only), you should still complete the FAFSA Application. Although you have missed the opportunity to be considered for Cal Poly Pomona and California State Grant funds for the year, there are other aid programs available to you.

In addition to the aid programs listed below, some scholarships, or private loans may require you to complete the FAFSA application to be considered.

Financial Aid Programs at Cal Poly Pomona that are not impacted by the Priority Filing Deadline:

- Federal Pell Grant

- Federal TEACH Grant

- Federal Direct Loans

You will have the opportunity to be considered for Cal Poly Pomona and California State Grants next year – when you complete the FAFSA again (you must complete a new FAFSA for each academic year). The FAFSA becomes available every October 1st.